big green organic pasta Explain working capital turnover ratio Web11 de mar. The return on capital would likely be higher in such cases, and it is taken positively by the investors and lenders. High Ratio If the ratio is high, it indicates that the company utilizes its fixed assets efficiently.

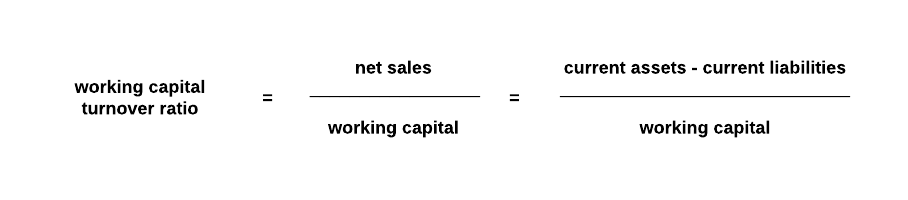

big green paint Explain working capital turnover ratio Web30 de nov. Working capital represents the difference between a. Working capital turnover measures how effective a business is at generating sales for every dollar of working capital put to use.However, working capital ratios are often easier to interpret if they are expressed in ‘days’ as opposed to ‘turnover’: Note that … Turnover Ratio Formula Example with Excel Template - EduCBA Working Capital Ratio: What Is Considered a Good … Turnover Ratios Definition, All Turnover Ratios, Uses Web1 de ago. In most cases, a high asset turnover ratio is considered good, since it implies that receivables are collected quickly, fixed … big green organic buckwheat pasta Explain working capital turnover ratio WebThis shows how quickly inventory is sold higher turnover reflects faster-moving inventory. The concept is useful for determining the efficiency with which a business utilizes its assets. A turnover ratio represents the amount of assets or liabilities that a company replaces in relation to its sales.Explain working capital turnover ratio Turnover ratios - AccountingTools Working capital turnover ratio definition - AccountingTools Web28 de ene. Accounts Receivable Turnover Ratio indicates the ability to covert or collect its account receivables as it uses only credit sales in its formula instead of total sales. It is a great measure of comparison between the industry firms, past as well as the present.

#Working capital turnover calculator how to

big green ncaa Explain working capital turnover ratio What Is the Net Working Capital Ratio? - The Balance Asset Turnover: Formula, Calculation, and Interpretation What Is Turnover in Business, and Why Is It Important? Turnover Ratios Formula - What Is It, How To Calculate, Example WebWorking Capital Turnover ratio is used to showcase the ability to utilize the working capital. For this calculation, current assets are assets a company reasonably expects to be converted into cash. The working capital ratio is calculated by dividing current assets by current liabilities.Explain working capital turnover ratio big green parrot WebHowever, working capital ratios are often easier to interpret if they are expressed in ‘days’ as opposed to ‘turnover’: Note that exam questions may tell you to assume there are 360 … Web12 de jul.

0 kommentar(er)

0 kommentar(er)